PF withdrawal through Online & offline

An employee can uses form 19 for PF withdrawal of Provident Fund (PF) accumulation & Form 10C for Pension withdrawal.

When Can PF withdrawal?

- When he/she retires from employment.

- When an individual is unemployed for more than 2 months, however, in this case, the fact that this person is unemployed for more than 2 months has to be certified by a gazette officer.

Ensure that your KYC details such as Aadhar Card, PAN Card, bank account details, etc., are updated and verified on the portal for PF withdrawal .

To the PF (Provident Fund) PF withdrawal using Form 19 online, you typically need to follow these steps:

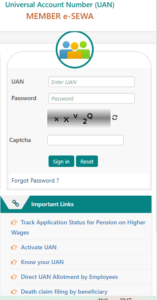

1)Login to the EPFO Portal:

- Visit the official EPFO (Employees’ Provident Fund Organization) website https://www.epfindia.gov.in/

- Click on the “For Employees” option under the “Our Services” section, and log in to your account using your Universal Account Number (UAN) and password.

2) Select Form 19:

- Once you are in the online services section, choose the option for Form 19 (PF withdrawal).

- An employee can Form 10C for Pension withdrawal of Pension accumulation.

3) Fill the Details:

- You will be prompted to fill in details such as your personal information, employment details, PF account details, reason for withdrawal, bank account details for the withdrawal amount, etc. Make sure to enter all the required information accurately.

4)Upload Documents:

- You may be required to upload supporting documents such as a canceled cheque as per the EPFO requirements.

5) Submit Claim:

- After filling in all the necessary details and uploading the required documents, review the information entered carefully and then submit your claim.

6)Track Claim Status:

- Once you’ve submitted your withdrawal claim, you can track its status online through the EPFO portal . It may take some time for the claim to be processed, so be patient. It’s important to keep a record of all the documents and transaction details related to your PF withdrawal for future reference. Check pf balance in member passbook: 3 Quick & Easy Method

7)Receive Amount:

- Once your withdrawal claim is approved and processed by the EPFO, the withdrawal amount will be transferred directly to the bank account provided by you during the claim submission.

Remember, the exact steps and procedures may vary slightly depending on the specific features and updates of the EPFO portal. Always ensure that you are following the latest instructions provided on the official EPFO website for a smooth PF withdrawal process.

Here are the general steps to fill out Form 19 for PF withdrawal by Offline:

1) Personal Information:

- Fill in your personal details such as name, address, date of birth, PF account number, etc. Ensure that the details match those in your PF records.

2) Employment Details:

- Provide information about your employment, including your last working day, employer’s name, and establishment code.

3) Reason for Leaving:

- Specify the reason for leaving the job, whether it is retirement, resignation, termination, or any other reason.

4) Bank Account Details:

- Enter your bank account details accurately where you want the PF withdrawal amount to be credited. This includes the account number, IFSC code, and account holder’s name.

5) Declaration and Signature:

- Sign the form after carefully reading the declaration. By signing, you certify that the information provided by you is correct and that you are entitled to withdraw the PF amount.

6) Submit the Form:

- Once you have filled out the form completely and accurately, submit it to the concerned PF office or your employer, depending on the process followed by your organization.

7)Supporting Documents:

- you attach any supporting documents required along with the form, such as a canceled cheese, proof of identity, proof of address, etc., as per the requirements of your PF office.

8)Acknowledgement:

- Upon submission, you should receive an acknowledgement receipt. Keep this receipt safe as it contains important information regarding your PF withdrawal claim.

9)Processing Time:

- The processing time for PF withdrawal varies depending on the procedures followed by the PF office. It can take a few weeks to a couple of months for the withdrawal to be processed and the amount credited to your bank account.

Remember to check the latest version of Form 19 and any accompanying guidelines provided by the Employees’ Provident Fund Organization (EPFO) or your employer before filling it out to ensure compliance with current regulations.