Check pf balance in member passbook: 3 Quick & Easy Method

Learn how to effortlessly check PF balance in Member Passbook an online platform provided by the EPFO. Follow our step-by-step guide to access and download your transactions, ensuring financial transparency and empowering you to plan for a secure retirement.

There are 3 method of check PF balance in Member Passbook.

- You can giving a Missed call to 9966044425 from their registered Mobile number

- You can sending an SMS at 7738299899 from registered mobile number.

“EPFOHO UAN” to 7738299899 - You can use the Member Passbook facility provided by the Employees’ Provident Fund Organization (EPFO) in India.

Why Check pf balance in member passbook?

In summary, checking PF balance is not just about knowing the numbers; it’s about taking control of your financial well-being, ensuring accuracy in contributions, and making informed decisions for a secure and comfortable future.

-

- Financial Planning:

- Regularly monitoring your PF balance allows you to assess your financial standing and plan for future expenses, investments, and goals.

- Retirement Planning:

- The EPF is a key component of retirement savings. Knowing your PF balance helps you gauge the progress of your retirement fund and make necessary adjustments to meet your retirement goals.

- Verification of Contributions:

- Checking your PF balance ensures that your employer is making the correct contributions on your behalf. Any discrepancies can be addressed promptly to avoid financial complications in the future.

- Emergency Fund Assessment:

- Your PF balance can serve as part of your emergency fund. Being aware of this balance allows you to assess your financial preparedness for unexpected expenses or emergencies.

- Interest Calculation:

- The EPF balance includes both your contributions and the interest earned on them. Regularly checking your balance helps you understand how your money is growing over time.

- Loan Eligibility:

- In certain situations, you may be eligible to take loans against your EPF balance. Knowing your PF balance is essential for understanding your loan eligibility and making informed financial decisions.

- Tax Planning:

- Contributions to the EPF are eligible for tax benefits. Monitoring your PF balance helps you plan your tax liabilities and take advantage of available exemptions.

- Verification of KYC Details:

- Your EPF account requires accurate KYC (Know Your Customer) details. Checking your PF balance prompts you to ensure that your personal information, such as Aadhar, PAN, and bank details, is up to date.

- Peace of Mind:

- Knowing your PF balance provides peace of mind, assuring you that your hard-earned money is being managed and growing steadily for your future financial security.

- Financial Planning:

- Stay informed, stay in control – Check pf balance in member passbook Today.

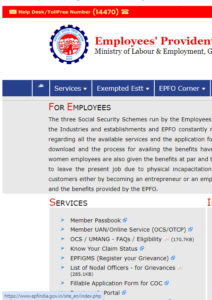

Check pf balance in member passbook ,Here is how you can do it:

-

Visit the EPFO Portal:

- Go to the official EPFO website: https://www.epfindia.gov.in/

-

Log in to your EPF Account:

- Click on the “For Employees” option under the “Our Services” section.

- Select “Member Passbook” from the drop-down menu.

- You will be redirected to the Member Passbook login page.

-

Enter your UAN and Password:

- Log in using your Universal Account Number (UAN) and password. If you have not registered yet, you need to do so first. Activate UAN Online know The Easiest Way?

- If you face any issues or have forgotten your password, there are options on the portal to reset it.

-

Check PF balance Passbook:

- Once logged in, you can view your EPF passbook, which will show the contributions made by both you and your employer, along with interest accrual.

-

Download or Print Passbook:

- You also have the option to download or print your passbook for future reference. Additionally, some companies provide their employees with an SMS service to check EPF balance or provide statements periodically.

6.You can check with your employer if such a service is available.

-

- Click on the Home page find the your Current Establishment Details , Member wise Balance, EPF Contribution Summary .

- Click on the Profile page find the your Personal Detail, Basic Details, KYC Details, KYC Nomination Details & Nominee Details.

- Click on the Passbook Page find Select Member ID tab drop Option select your Member ID & View Your Years wise Contribute with your Pension Contribute.

- If your Employer was Exempted so don’t show Your Member Passbook.

- Click on the Claims Page find the Claims Summary & Claims Details. like Pending Claims , settled Claims, Rejected claims with rejected reasons.

- Click on the Service History find the Service Overview Total Experience, Date of Joining, Total NCP Days.

- Service History for all Individually Employer Details.

It is important to note that you need to have an active UAN and your mobile number should be linked to your EPF account for successful login and verification.

Keep in mind that the process might evolve, and it is always a good idea to check the official EPFO website or contact your employer for the most up-to-date information.

Please note that you need to have an active UAN and link it with your employer’s establishment ID for accessing the Member Passbook facility online. If you haven’t activated or linked your UAN yet, please contact your employer or HR department for assistance.

Alternatively, if you prefer a more convenient method, you can also use mobile applications provided by EPFO to access and download your member passbook on smartphones.